Typical timeline

Typical timeline — 2–4 weeks

Model demand, CAPEX and risk scenarios with agronomic, commercial and regulatory evidence drawn from 30+ deployments worldwide.

When investors, municipalities or boards require market, technical and financial validation before funding vertical farms, hydroponic greenhouses or community food infrastructure.

Collect existing business plans, site data, energy tariffs and strategic goals; align on personas and KPIs.

Evaluate demand, competition, climate and infrastructure constraints using local datasets and project analogues.

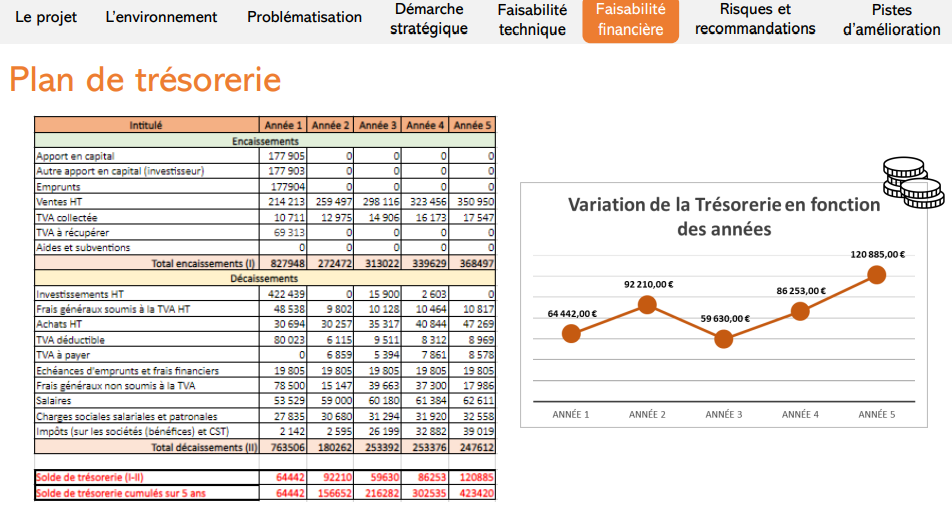

Build CAPEX/OPEX, cash flow and scenario models with yield, pricing and utilisation assumptions.

Assemble narrative, risk register and go/no-go recommendations; brief decision-makers and prepare revisions.

Typical timeline — 2–4 weeks

Investors receive validated numbers to unlock funding, with scenario ranges tested against climate and supply volatility; informs downstream design scope.